If It is Good Enough for Dorothy Day, It is Good Enough for Me

As I awoke one morning several years ago, I suddenly realized that I could no longer tolerate most of my tax money going towards the creation of nuclear weapons or anything supporting militarism. It was time to face the music, as they say, and live up to my beliefs. For me, it is wrong—even a sin—to support anything that involves taking a human life.

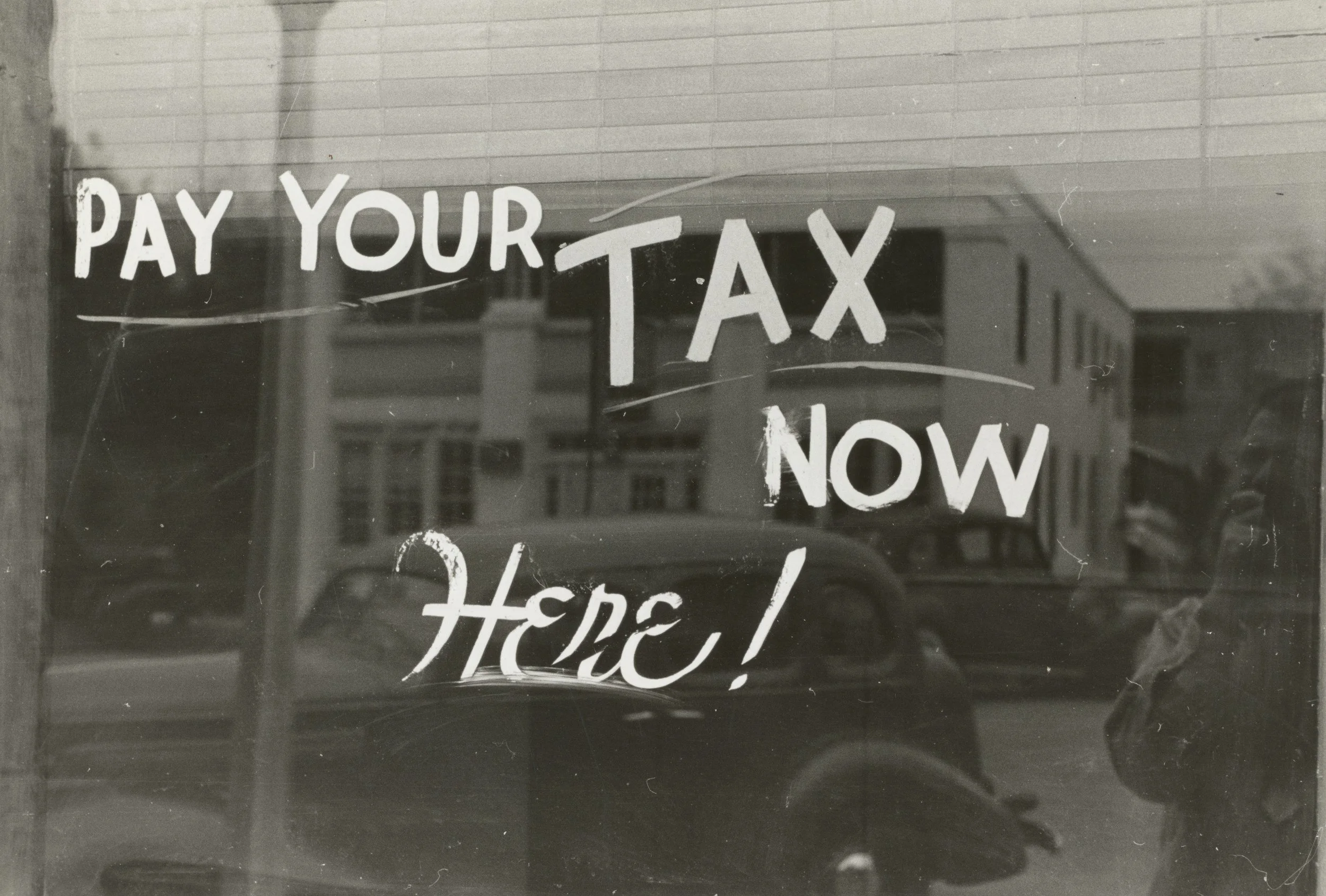

I do not file income taxes.

Neither did Dorothy Day.

People have been grappling with the implications of paying taxes to a violent state for millennia. Luke’s gospel includes a scene where the Pharisees ask Jesus “Is it lawful for us to pay tribute to Caesar or not?” This was their attempt to trap Jesus in an act of rebellion against the state. Jesus asks them to show him the denarius, the Roman silver coin required to pay taxes, and asks his questioners whose face is on the coin. They reply, Caesar’s. Then Jesus states, “Then repay to Caesar what belongs to Caesar and to God what belongs to God.”

In this story in Luke’s gospel, Jesus is saying that we need to give everything, our hearts, minds, souls, all that we are, to God. In other words, they could honor the requirements of the Roman government without believing in all the government stands for and still dedicate themselves to God. The question for us today is can we in good conscience do the same—continue to fund a government that is wholly taken up with war, destruction, and killing? Dorothy Day said no.

Day, the co-founder of the Catholic Worker movement said, “Once you give to God what is God’s, you have nothing left to give to Caesar.” Her situation had a lot to do with whether the Catholic Worker should be considered tax-exempt. The Federal Government served her and the Catholic Worker for back taxes of $296,359 including penalties. The IRS explained that the movement, which helped the needy, could not receive tax exemption as a charity because it had never filed an application. Day said she refused to sign the application on a “matter of principle,” declaring that it “would mean an endorsement of the Federal Government’s military spending and continuation of war.”

Day and the Catholic Worker fought the IRS and won the $296,359 tax battle with the Federal Government.

On April 28, 2020, David Hartsough, a lifelong peace activist from San Francisco, posted the following statement in reference to an article by the War Resister League and NWTRCC—“As a long-term war tax resister, my understanding is that it is NOT illegal to refuse part or all your taxes if you honestly fill out your 1040 form(s) and send a letter explaining why you cannot in conscience pay taxes for war. And I have heard of no one in many years/decades who has been arrested and served time in jail or had their home or car taken by the IRS for nonpayment of taxes.”

Knowing that most of my money would be going into funding military spending, an increase in developing nuclear weapons, and the continuation of war, my decision was to stop filing. I can no longer cooperate with this type of government.

The worst part of not filing is not contributing to the part of taxes that do pay for humanitarian services, including local taxes that are necessary to keep needed services functional—even services that I receive. This is the difficult part of this decision.

Will I get into trouble? Perhaps. But I doubt it. The last time I filled out income tax papers I owed a mere $118. I do not worry about my accountability to my country when I see the unaccountability of the military complex.

Today, many people either out-and-out refuse to file income taxes because too large a portion of the money goes to military buildup, nuclear weapons, and the continuation of wars. Others do a complicated figuring of their individual tax debt, deducting the percentage that is indicated to be going to military spending.

Members of The War Resisters League (WRL) state that war is a crime against humanity, and they are dedicated not to support any kind of war and to “strive nonviolently for the removal of all causes of war.” They offer a publication entitled “Where Your Income Tax Money Really Goes” that analyzes the Federal Fiscal 2024 Budget.

The National War Tax Resistance Coordinating Committee (NWTRCC) is a coalition of local, regional, and national groups and individuals in the United States interested in or actively refusing to pay taxes for war. They offer information, support, resources, campaign sponsorship, referral, and publicity to an international network of conscientious objectors to war taxes.

As the United States continues to expand its military spending, with no accountability, it is time for more people to take a long hard look at what portions of income taxes go to different government programs.

Are we complicit by funding the war machine with our taxes in the deaths of so many of our fellow human beings who are being killed daily in all the wars now taking place in our world?

Recognizing how your dollars are being spent, ask yourself: Will your conscience allow you to fund war and destruction? If not, how will you object? In the least, you can badger your elected representatives to work for changes to our taxation system and the congressional allocations of your funds.